If you're familiar with the basics of Job Costing, you know that data tracking is what makes it special. Important details, like labor, materials, and equipment are associated with the jobs they pertain to, rather than being lumped together with all other business expenses. This allows you to see a level of granular detail in your reporting that wouldn't otherwise be available.

What are the various types of Job Costing reports?

Job Cost Summary Report - This gives you a basic overview of all the projects you have open during a given time period. It shows the total costs for each job, revenue, and profitability. It's a quick way to compare your jobs and see which ones are costing the most.

Job Cost Detail Report - This will give you a more detailed breakdown of project costs. It includes the direct costs (labor, materials, subcontractors) as well as indirect costs like overhead and administrative expenses. When you want to see everything that goes into a job, you can dig into a detailed report like this to find out the specific answers.

Bonding Report - A Bonding Report gives a picture of each job's financial status. Details include contract price, budget, expenses costs to date, billed to date, estimated total cost, profit, and over or under billings. This is required for working with bonding companies or banks.

Profitability Analysis - This one is mainly focused on the revenue produced by each job. This report compares your contracted revenue against your expenses. Using your budget, a good accounting system can forecast the job's profitability before the project is completed.

Labor Cost Analysis - If you want to investigate your labor expenses in detail, this is the report you'll need. By proactively checking these reports for each job, you can see if the work is being done efficiently. You may uncover some wasted time or find complications that your workers are facing.

Materials Usage Report - This is obviously how you learn more about your specific material costs. You may notice some higher costs than usual, which could turn up some interesting information. It's better to find this during the build process, rather than after the job ends.

Subcontractor Cost Report - If you're a general contractor, you'll want a good software with subcontract management. This can give you a report with all your subcontractor costs broken down by job.

Overhead Cost Allocation - It's hard to accurately calculate the profitability of a job when overhead hasn't been taken into account. This includes office expenses, like rent, utilities, office supplies, equipment maintenance, and administrative costs. In order to get a true picture of how a company is doing, these costs must be divided up and allocated to the various jobs. The overhead cost allocation report shows the various methods to allocate those costs.

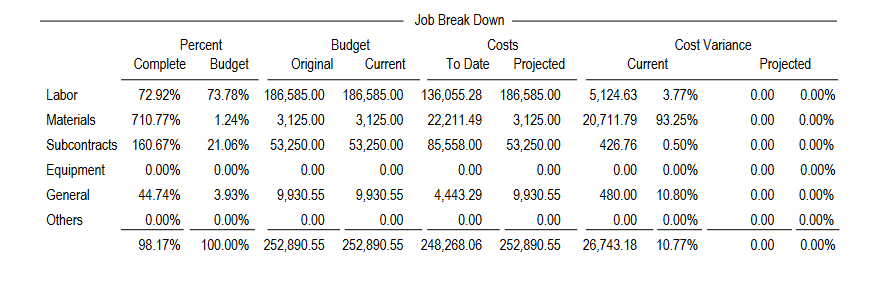

Cost Variance Report - This report is critical. It compares your estimated costs (budget) to your actual costs. This report can be run all throughout the progress of a job. It helps you keep an eye on cost overruns, as well as showing where you may have saved money. This is one you'll want to monitor regularly, because this is what protects your business from runaway costs. If something is out of line, you'll want to know about it sooner than later. That will give you time to address any issues that have come up.

Work-in-Progress (WIP) Report - This is an interesting report that looks at the job's status a little differently. Instead of just reporing that the job is roughly halfway done, for example, it looks at progress in terms of the value of the completed work. It takes into consideration how much labor and materials have been used, and from that info you can estimate the percentage of completion. If a job is budgeted for $50,000 and you've spent $25,000, you can guess that you're around halfway done.

Clients like to see WIP reports so they can get a quick view of their job's status.

Client / Project Profitability - This type of report is run after projects are complete. It compares the profit made from each client, or each type of job you've done. You can decide if contracting for the government, for example, is more profitable for you by simply comparing those jobs to private sector jobs. This helps you decide which clients you'd like to pursue for future work, allowing you to make maximum profit. You may also find that your company is great at framing and drywall, but you keep losing money on flooring jobs. These reports will help you objectively look at your business activities and choose the most profitable ones.

Job costing reports can be customized to suit your needs. Different parties will be interested in different data. A job owner will want to make sure things are on time and on-budget. A foreman may want to check on labor hours and make sure everything is running efficiently. Keeping tabs on all this data helps managers make better decisions.

Reports can, of course, be printed and physically handed out. Although many offices choose to go paperless, many people still appreciate a paper report. It's easy to highlight it and make notes on it. It's also 20% easier to read a paper than a screen.

Alternatively, there are a number of options if you stick with a digital report. You can send a link to view the report if you're using a cloud hosted software. You can also email a pdf copy of a report to all relevant stakeholders. This is handy, because they can choose to print the report if they choose. If not, they can save a bunch of money on ink and toner.

Accounting software comes with default reports. You can run a standard report and get the most commonly requested information. However, some software offers the ability to customize your reports. This is handy when you have a specific piece of information you'd like to focus on. Custom report writers often act as an add-on feature, and may add to your software's overall cost.